July 27, 2023

2nd Quarter 2023: Investment Perspective

A TALE OF TWO FORECASTS

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way – in short, the period was so far like the present period, that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only.

Charles Dickens, A Tale of Two Cities

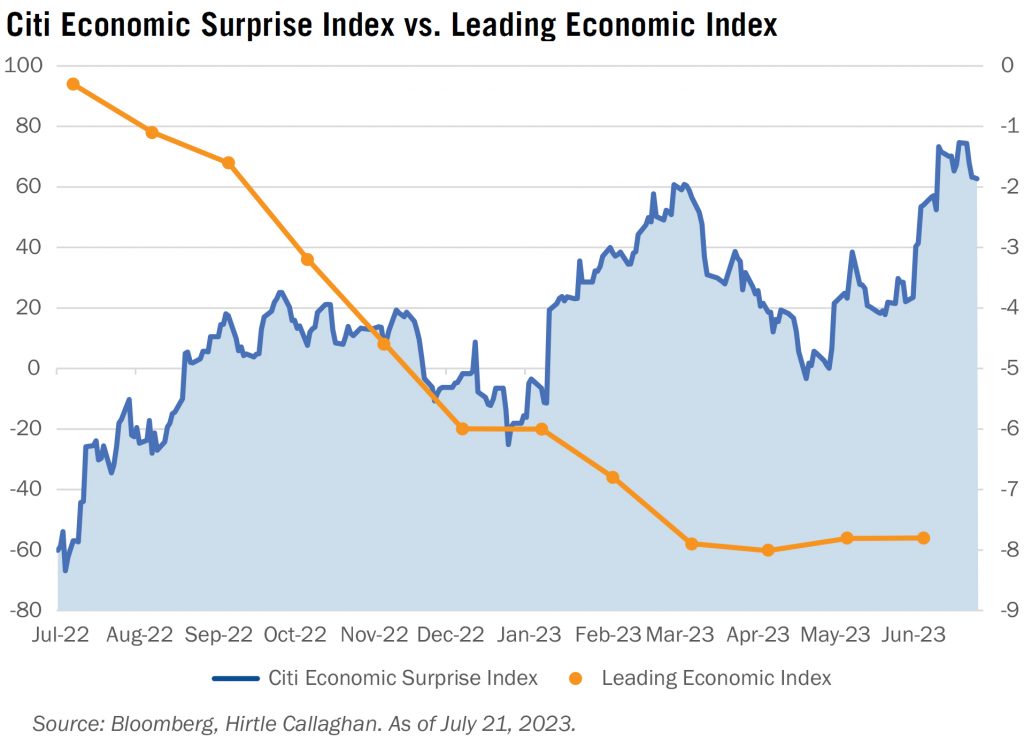

Every time and place comprises divergences – trends drifting in opposite directions. Dickens’ famous assessment of the conditions of Revolutionary France and its likeness to Victorian England reminds us that human society is always in a kind of flux. Anyone who has lived through the vicissitudes of financial markets this past year will sympathize. One year ago, the U.S. appeared headed for a slowdown. Many measures of economic activity were slowing – especially industrial production, home building and the automotive sector. But since the turn of the year, almost every indicator has surprised to the upside. However, a no less respected measure of the economy’s central tendency – the Index of Leading Economic Indicators – has trended steadily downwards. Even within markets, the contrasts are striking. The bond market is implying an evolving slowdown, while equities are within striking distance of all-time highs. The inconsistency even reaches into the internals of asset classes. As equities have inexorably drifted upwards, analysts’ forecasts for 2024 earnings have been steadily marked down. It seems we have everything before us and nothing before us.

What are we to make of a chaotic market? First, the economy is a complex system. Let’s acknowledge it’s inherently indeterminate. Investing across a broad mix of public domestic and non-U.S. corporate equities exposes us to the growth of the world economy and guards our real purchasing power. The more uncertain the environment, the more advisable broad diversification. With hindsight, some investors will always appear to have been prescient. Someone out there was short U.S. regional bank stocks before Silicon Valley Bank’s seizure. And someone surely scooped up the regional banks after the wind-up of First Republic. Fortunes were made and heroes declared within a brief window. On the other hand, investors in their totality held every share of every bank at exactly its market cap weight at every point. On balance, the gains of the victors must exactly equal the losses of the victims. Sam Bankman-Fried even managed to incarnate both avatars – in the fullness of time.

The second solution to topsy-turvy markets is to allocate capital to less efficient private asset markets. Participating in non-auction markets, markets with information asymmetries or where highly specialized structuring skill or other factors besides price can lead to excess returns. We all use mechanics, jewelers, opticians, attorneys and tailors every day. I will speak for myself, but I am certain that those transactions are never the lowest possible price. Expert advice, service, judgment and trust in those relationships matter more than price.

A third strategy is what Cliff Asness calls ‘sinning a little’ or Howard Marks has termed ‘taking the temperature of the markets.’ The sense is that while markets are predominantly efficient, they can occasionally over discount expectations of outlier events. That may be completely rational for market participants who are particularly levered or have other constraints. But it may present opportunities for investors with longer horizons. For the past several years, we have employed a strategy of selling options on stock index futures. We collected an option premium in exchange for agreeing to rebalance into stocks at lower levels. Those instruments regularly price in a higher likelihood of volatility than that which is realized. Hence the strategy goes by the generic term ‘Volatility Risk Premium’ harvesting. It arises from participants who persistently over-pay for insurance – perhaps for very rational purposes. Another example was our decision to underweight duration in our fixed income portfolio. With an inverted yield curve, we were able to earn higher income in exchange for giving up the capital appreciation that would accrue to longer duration bonds in the event of a severe recession. It seemed to us that investors were either overpaying for the recession insurance or more concerned about immunizing an equivalent duration liability than a strict assessment of risk/reward would justify.

In my thirty years of following the economy and markets, I struggle to recall a time as fraught with mutually inconsistent indicators. I find it impossible to weave together a single economic narrative that incorporates all the metrics into a logical whole. The best explanation is that the spread of potential paths is actually wider than normal. Thus, everyone is hedging their bets by ‘buying the tails.’ In that scenario, I find it perfectly conceivable that the same investor is both buying unprofitable software companies on 10x sales for a soft-landing / AI supercycle and buying 10-year Treasurys with a negative term premium for a hard landing and buying oil services stocks in the event of stagflation. Ralph Waldo Emerson cautioned: “A foolish consistency is the hobgoblin of little minds, adored by little statesmen and philosophers and divines. With consistency a great soul has simply nothing to do.” For the time being, we should all take his advice.

—T. Brad Conger, CFA

Deputy Chief Investment Officer

On a quarterly basis, Hirtle Callaghan publishes our perspective on the current market. If you would like to be added to our distribution list and receive the full version of our latest Investment Perspective piece, please contact us.

To download a pdf of the excerpt, click here: Investment Perspective Q2 2023 Excerpt.