April 28, 2023

First Quarter 2023: Investment Perspective

THE VICTORIAN SVB

Investors became enamored by the profit potential of a new technology. Fortunes were being made both by the promoters and early investors. Thousands of companies were formed to exploit the technological revolution. One financial institution sat at the nexus of the technology ecosystem. But financial conditions were becoming tighter. The central bank was increasing base rates to offset the inflationary impulses due to a war on another continent. Concerns arose about the solvency of the bank. A run ensued, and the bank imploded.

The year was 1866. For the prior decade, the UK had been swept up in a railroad investment mania. Between 1850 and 1865, track mileage doubled. In 1855, the UK had 31 registered joint stock companies. By 1860, 475 companies were registered, and by 1864 that number rose to 975. In the early 1860s, new capital raises for railroads amounted to almost 5% of GDP annually. The financial firm Overend Gurney had become the dominant source of finance for the railroad industry. As the mania progressed, the Bank of England raised the base rate from 2% to 7%, partially to offset the inflationary impact of the U.S. Civil War. In May 1866, rumors circulated as to the soundness of Overend Gurney. Overwhelmed with redemptions, the bank applied to the Bank of England for assistance. It was denied, and the bank collapsed.

The parallel between the collapse of Overend Gurney in 1866 and Silicon Valley Bank is not meant as some kind of evil portent. The London Stock market went through a brief swoon over the subsequent 18 months, falling about 15%. The UK economy did not go into a recession. The creditors of the bank were paid out in full with interest. The shareholders of the bank did suffer enormous losses since their liability was in practice not limited to their investments. And railway investors broadly were not wiped out, though most railway shares underperformed government bonds.

Since Silicon Valley Bank was seized on March 10, the general assessment has been that the bank was an outlier among U.S. banks. And that is true. Its assets were grossly mis-matched to its liabilities. Its deposits were overwhelmingly above the FDIC insurance limit. And, worse still, many of the bank’s depositors were linked through common ownership or informal networks. It was a tinderbox awaiting a spark. But it was a tinderbox standing all by itself. The risk of contagion to the U.S. banking system was probably minimal. Nevertheless, it took all of 48 hours for the Federal Reserve and U.S. Treasury to declare the bank “systemic.” In theory there’s little difference between practice and theory. But in the end, Secretary Yellen and Chairman Powell decided not to risk submitting theory to practice. Given the general atmosphere, extending the deposit guarantee to uninsured depositors of SVB and Signature was the correct decision.

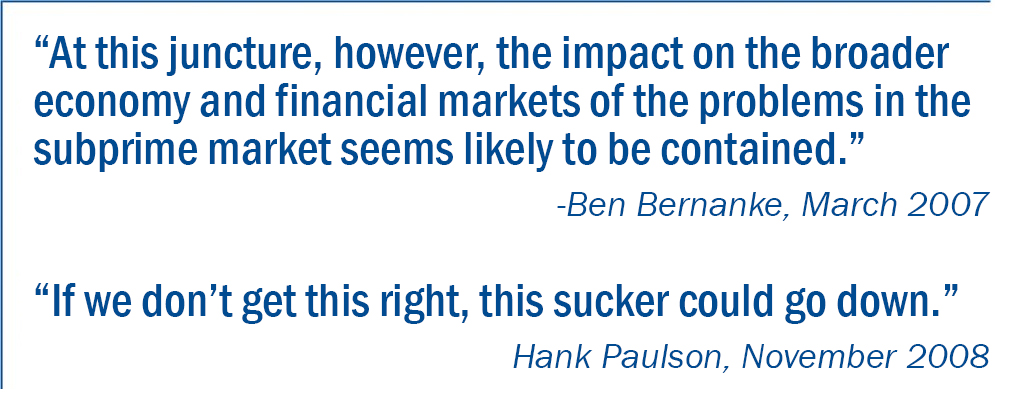

Silicon Valley Bank was indeed aberrant, but certainly not irrelevant. SVB was felled by an ill-conceived bet that interest rates would not rise both substantially and sustainably. And when that proved not to be the case, management, the board of directors and the regulators failed to address the vulnerability. The Federal Reserve’s own self-review is predictably anodyne. The 118-page report essentially concludes that the plane crashed because of the absence of lift. However, there was one revealing line in the report in Vice Chair Barr’s introduction: “More than a decade of banking system stability and strong performance by banks of all sizes may have led bankers to be overconfident.” ‘Overconfident’ about what exactly? Let me hazard a guess: overconfident that low rates, low inflation and low credit risk are permanent. And that is what makes SVB so salient. Silicon Valley Bank was only extreme in degree, not in direction.

The Fed Funds rate sat at the lower bound from late 2008 until early 2022 except for an aborted hiking cycle from 2016-2018. Over this time the Fed acquired $7.5 trillion of Treasurys and mortgage bonds. By extinguishing safe asset yields, the authorities hoped to encourage investment and growth. It did increase investment. But instead of investing in real assets, investors ploughed into stocks, real estate, venture capital and collectibles. For the timid souls who just wanted some modicum of income, Wall Street securitized every conceivable income stream. From royalties on drugs, music and oil and gas to lease revenues on ships, railcars and aircraft. Anything that wasn’t nailed down was wrapped up in an investment vehicle, levered and sold to the public. But slowly, perniciously a grim reaper has been stalking this whole edifice. A perfectly riskless, daily-liquid alternative with negligible management fees. That angel of death is the 3-month U.S. Treasury yielding 4.9%. Of course, I am exaggerating by not accounting for inflation. Inflation is running at 4-4.5% so the real yield on the T-bill is 0.50% – 1.00%. All of the investments I mentioned above have some real characteristics meaning that they are effectively capturing inflation.

But no matter how excited you are by the returns on your collection of Birkin bags, you must acknowledge that your cost of capital has gone up by 2-3% over the past 18 months. That fundamental re-appraisal is coming for every asset class. The UK pension funds’ LDI portfolios, Blackstone’s private REIT and now Silicon Valley Bank are just the first casualties. Why those unfortunates? Because they were most levered and had the shortest duration of liabilities. So, they were most vulnerable to slight changes in asset values having to satisfy the nearest maturing liabilities. The next in line are U.S. commercial real estate portfolios. Pre-pandemic loans with exceptionally good borrowing rates are facing both steep re-financing rates and diminished performance expectations. The next bank problem will probably not center on the duration mismatch and customer concentration. It will be about solvency after recognizing real estate loan losses.

The most significant legacy of SVB is oddly unrelated to the bank’s portfolio and customers. For one weekend in early March, many households in America gave at least a passing thought to their deposit accounts. And that was exactly what the banks did NOT want anyone to do. Because for the past year, as safe Treasury bill yields crept steadily from right of the decimal point into significant digits, bank deposit interest rates stayed firmly in age of the zero lower bound. Last December, the CEO of Wells Fargo explained to investors their deposit rate setting process: “There is deep analysis that you need to do about how much you can get away with in terms of not passing on rate in the shorter term versus what do you lose in the longer term for not treating customers properly.” Let me guess. That ‘deep analysis’ that Wells Fargo performed did not include the assumption every single customer would open their statement on March 10th and discover how clever its bank had been. Deposits are thus steadily draining out of the system – not because people are worried about the safety of banks but because they noticed their lack of generosity. As their liabilities shrink or become more costly, banks will be pressured to reduce lending and increase loan interest rates to maintain margins. As the Federal Reserve has raised interest rates over the last 15 months, it seemed odd that the only damage seemed to be in the mortgage / home building business. The economy’s resilience seemed to suggest a surprisingly low sensitivity to rates. With the retrenchment of bank lending, we may finally see some impact.

Catastrophic bank collapses like those of Overend Gurney and SVB capture our imagination because of their dramatic and abrupt nature. This suddenness is just an appearance. Just like a damn break is the culmination of a slow undermining of its foundations and structures, the implosions are the climactic finale of years of accumulating weaknesses. In that sense, financial calamities often represent watersheds where one era transitions to a new one. It’s not a given, of course, but I think historians may write about SVB as the end of the era of easy money.

—T. Brad Conger, CFA

Deputy Chief Investment Officer

On a quarterly basis, Hirtle Callaghan publishes our perspective on the current market. If you would like to be added to our distribution list and receive the full version of our latest Investment Perspective piece, please contact us.

To download a pdf of the excerpt, click here: Investment Perspective Q1 2023 Excerpt.