January 31, 2023

Fourth Quarter 2022: Investment Perspective

DOUBLE FALL LINE SKIING

Downhill skiers intuitively understand the fall line. It’s the imaginary path of least resistance an object would travel downhill. Advanced skiers ski down the fall line. Everyone else skis across the fall line and drives the experts crazy. Some slopes have a double fall line. That is, they have a primary line of descent and a secondary gradient at a tangent. It’s trivial for the double-black-diamond set. They still go straight down. But they are really annoying for the rest of us. The turns become asymmetric, so you have to vary your edge pressure from one side to another. Add in trees and low visibility, and it becomes challenging. I think it’s an apt description for the current investing landscape.

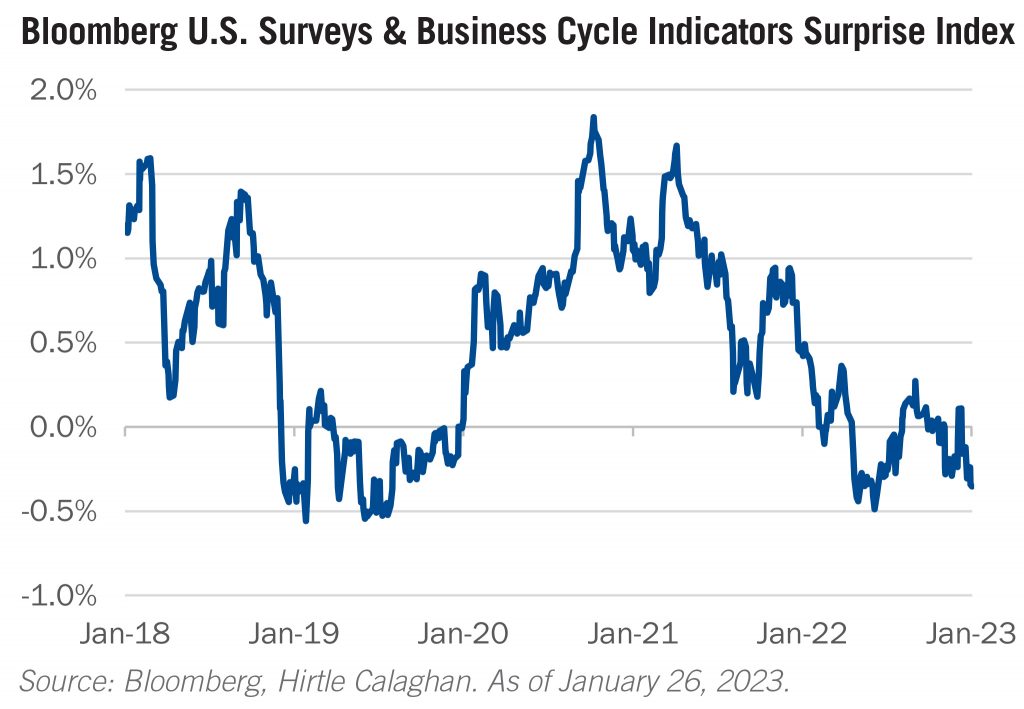

The primary direction of the economy and corporate earnings is downward. The chart above is a synopsis of economic survey data scored by ‘surprise’ factor. Levels above and below the zero line measure degrees of surprise versus expectations. So a broad range of economic indicators has been underwhelming since early 2022. But the decline has not been monotonic. The overarching sweep has been punctuated by a couple strong reversals along the way. And the reaction of stocks to those has been perverse. Consider the end of September local peak in the ‘surprise’ index. It coincided with the year’s low point in equities. The message was clear. Good news for the economy meant the Federal Reserve would have to tighten policy. And those higher rates would ultimately inflict more pain on stockholders. A classic ‘good news’ (economy) = ‘bad news’ (stock markets) paradigm.

Now put yourself in the position of a fundamental equity analyst forecasting earnings. The bottom-up outlook for earnings improves into late September. All the while the stock market goes down. Then from early October till the end of January bottom-up analyst forecasts for S&P 500 earnings decline approximately 4%. The S&P 500 index rises 13% over the period. Well, of course, that’s because the U.S. Treasury 10-year yield moved down from 4.25 to 3.50%. Risk-free rates down, stocks up. But that only works if the required risk premium for stocks stays the same. Fortunately, for you, one quarter of the world’s population was allowed out of the house for the first time in three years. Adding to the uncertainty is the COVID bull whip effect. We binged on goods during the pandemic lockdown, creating a supply chain mess. Then we emerged from our Amazon/Peloton/Zoom-enabled hibernation. Suddenly Target had too many hibernation accessories. Goods demand imploded and everyone socialized again. Furniture and used car prices plunged, and hotel room nights/air travel exploded. In the meantime, there is the mystery of the two million people missing from the workforce. Surely, they weren’t all staying with SBF at the Albany. But then again, it is hard to square those catering tabs otherwise. Amidst all that confusion, the Federal Reserve was trying to give clear guidance, but nobody wanted to believe them.

The point is, there have been a lot of unusual impulses interacting – cancelling and reinforcing each other simultaneously and reversing just as quickly as they appeared. Maybe the double-fall-line slope analogy is inadequate. It was more like we were crossing over multiple intersecting ridge lines and saddles.

As long-term investors it can be salutary to disregard the noise of the daily headlines. Yes, the war in Ukraine appears to be hopelessly escalating. Yes, there will be a debt-limit stand off. But our returns as investors over the fullness of time are the cash flows generated by our investments. And there the outlook is optimistic. First, real interest rates are positive across the fixed income curve. Below we describe the case for Treasury Inflation Protected Securities. But other subsectors of fixed income credit are particularly cheap. Senior secured loans to high quality sponsored private businesses are yielding 11.5%. Very highly rated structured products are yielding 300 basis points over Treasuries. So, for the first time in more than a decade, fixed income can go a long way to satisfying your required return objective. Equities are priced more fairly. But U.S. corporates have done an admirable job of protecting margins in an extremely challenging period. So even if the Fed’s restraint drags earnings comparisons this year, the outlook for 2024 and beyond is bright. Finally, like many of you, we have been experimenting with new off-the-shelf artificial intelligence tools. While obviously at an immature stage, we are struck by the rate of improvement. It now seems probable that we will see truly breakthrough use cases interpreting unstructured data sets of natural language and images.

Over Christmas I rode the gondola with a ski patrol veteran. She said 90% of the injuries they carry off the mountain are due to skier collisions. It reminded me of the quote from the legendary Peter Lynch on the prior page. Amidst the uncertainty, it can be tempting to gather your talents and bury them away. To time the market effectively, you have to forecast not one but two inflection points better than the marginal investor. It’s not the slope conditions that get us hurt. It’s us.

—T. Brad Conger, CFA

Deputy Chief Investment Officer

On a quarterly basis, Hirtle Callaghan publishes our perspective on the current market. If you would like to be added to our distribution list and receive the full version of our latest Investment Perspective piece, please contact us.

To download a pdf of the excerpt, click here: Investment Perspective Q4 2022 Excerpt.