July 21, 2022

Second Quarter 2022: Investment Perspective

INSIDE AN ENIGMA

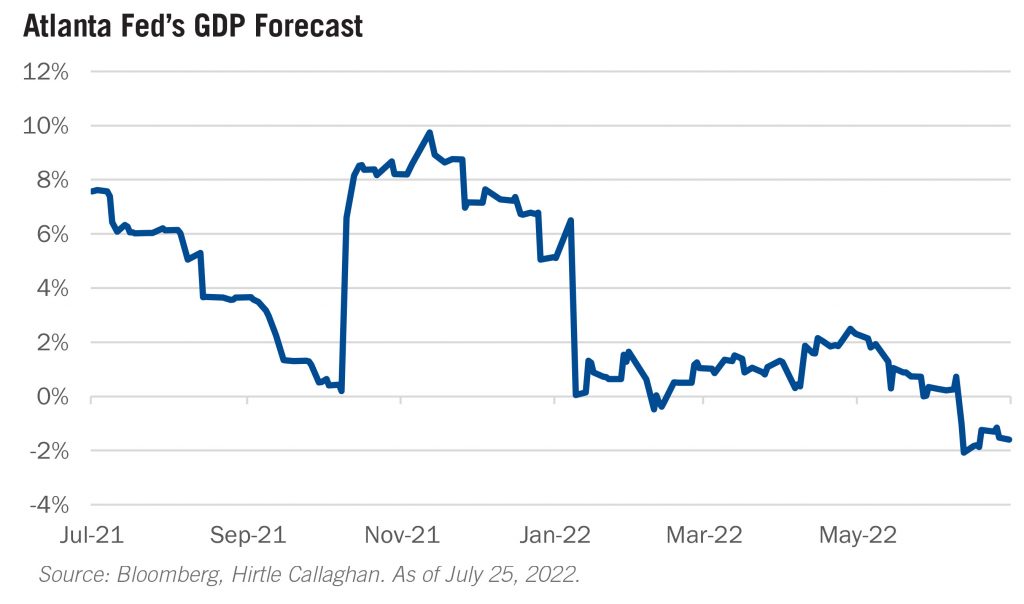

Whenever a problem is hopelessly intractable, we resort to Winston Churchill’s famous description of Russia’s political designs in 1939 — “It is a riddle, wrapped in a mystery, inside an enigma.” That would be a sufficient description of the outlook for financial assets. The two charts below provide the poles for the current dispersion of views. The first chart shows a real-time forecast for the quarter’s GDP according to a statistical model constructed by the Federal Reserve Bank of Atlanta. It recomputes based on the major economic updates on jobs, incomes, retail sales, production, etc. So, it’s a convenient compilation of all available inputs. I like it because it has no bias. Human forecasters will inevitably hang their hat on one element, say payrolls, and downplay housing starts. This model lets us see the world as objectively as the history represents. And that direction is clearly downward. It’s a shocking 2% below its human peers. So, the purely data-driven perspective is negative.

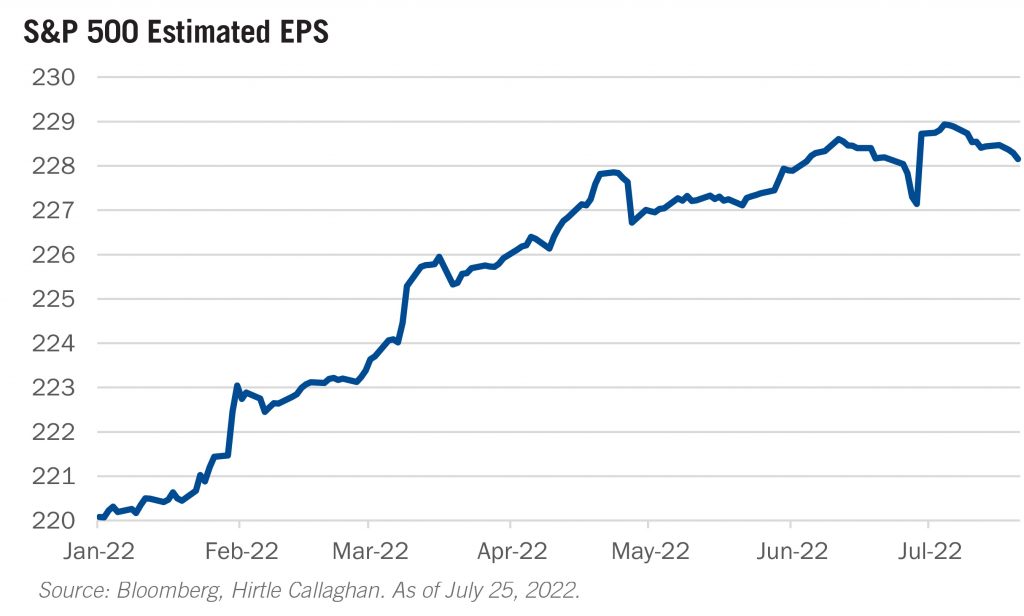

Now the conundrum. The second chart shows the evolution of bottom-up analyst forecasts for S&P 500 2022 company earnings. In the past eight weeks, while the Atlanta Fed model has taken second quarter U.S. GDP growth down 3.5%, analysts have marked up earnings for corporate America. We know a lot of that increase is due to a giant lift in energy earnings offset by a modest decrease in consumer discretionary estimates, but wealth transfers happen continuously and don’t take away from the result. For many jaded observers, this is another instance of overpaid corporate stewards whistling through the graveyard and dragging their sell-side lapdogs down the primrose path to oblivion. I worked on the sell-side at Goldman Sachs, so I share some of that disdain. But I think something is truly different here.

Commodities traders often talk about the difference between ‘paper’ markets and ‘real’ markets. The paper markets are exchanges of futures contracts settled for cash. The real markets represent exchanges of money for physical commodities. For economists this is a distinction without a difference. I mostly agree. I usually assume the person losing money is pointing to the irrationality of the other side — like the private equity sponsor/holder of a public company who complains that the public market does not ‘understand the fundamental value we are creating.’ But now, I think the ordinary scapegoating might have a case. That is, the participants in real or spot markets are really not seeing the same weakness that the surveys are capturing. David Ogilvy complained of surveys thus: ‘People don’t think what they feel. They don’t say what they think. And they don’t do what they say.’ In a time of enormous flux — where 22 million workers have been displaced and returned to a job in the course of 24 months — I think it pays to be respectful of both sides. In other words, the most telegraphed recession in history may not eventuate either so soon or so severely as all that. Let’s give the corporates their moment to speak. Peak earnings season is this week after all.

Now let’s move to the part of Sir Winston’s quote which does not seem to have garnered the attention it deserved. It continued, “…but perhaps there is a key. That key is Russian national interest.” He didn’t mean that certain questions were impenetrable, but that they had to be apprehended by an overriding logic — like Heisenberg’s agnostic particle whose position and direction could not be fixed. But you knew probabilistically where it was and where it was headed.

Unfortunately, I think the ‘key’ to our enigma will lie in inflation. I take the Federal Reserve at its word that it will not stop until it has inflation under control. No one believes Chairman Powell will have the titanic courage of Paul Volcker. Or that the severity of the slowdown will do the job so quickly, he can claim ‘mission accomplished’ by next Spring. I think that line of thinking is underestimating Powell and inflation at the same time. Here’s a simple thought experiment to explain an admittedly simple point. And, no, I am not expecting any citations in Journal of Financial Economics for this one. Suppose you work at a firm of 1,000 people. In the month of May, 28 of your colleagues quit and accepted new offers. (That was the actual economy-wide quit rate.) Your employer grants everyone else the economy-wide average hourly wage increase of 3.6% at an annualized rate. But here’s the rub. The 972 employees who stayed know precisely what the leavers accepted at their new position. It has become their new reserve price of labor. This is how inertia develops in inflation and why it’s so hard to eradicate. Rent works the same way. A small proportion of new tenant leases show up in the average, but everyone else knows what the new effective rent is. And another small observation. For years consumer packaged goods companies were terrified of raising prices to Walmart and Target. In the last 18 months, they just got a free pass to conduct a massive experiment on gauging what the true consumer price elasticity was. Some will understand they might have pushed the envelope too far. But plenty will have discovered — along with the retailers — just how much people like their brands. So gas, milk and eggs may find a level that equilibrates consumer and producer surplus. But it will be harder to wrench that pricing knowledge away from the others. In sum, I am less certain of the thesis for a quick decline in activity but also less enthusiastic there will be a rapid upswing due to an accomodating Fed.

Consequently, we contend with a wider range of outcomes than normal or, perhaps, than has been normal for the past 10 years. One of my favorite movies is the Coen brothers’ Miller’s Crossing. It’s a modern noir gangster film that I think rivals Chinatown. Gabriel Byrne plays Tom Reagan — a capo who is trying to look out for his boss. When his boss points out that he’s being overprotective, Tom says, “I would worry a lot less if I thought you were worried more.” The lesson for positioning portfolios is to be most concerned about the risks that you think are underappreciated and vice versa. At the moment, for us, this means maintaining a full weight to global equities. The world is overly obsessed with — and therefore more than adequately insured against — a recession. The financial world is relatively less concerned with the potential for an energy catastrophe in Europe this winter. Daylight is shrinking three minutes a day in Germany; the vital supply of fuel for the winter is slowly being strangled. Never has someone made their own Procrustean bed so diligently. Finally, we believe we have been granted an amazing opportunity to purchase inflation optionality at very attractive prices by the prevailing wisdom on inflation’s early demise. We look forward to sharing more of our thinking in this report and the weeks to come. As always, we value your trust and confidence.

—T. Brad Conger, CFA

Deputy Chief Investment Officer

On a quarterly basis, Hirtle Callaghan publishes our perspective on the current market. If you would like to be added to our distribution list and receive the full version of our latest Investment Perspective piece, please contact us.

Or click to download the Investment Perspective Q2 2022 Excerpt.